Easy Ways to Improve Your Financial Planning

In today's fast-paced world, sound financial planning is essential for securing a stable future.

Whether you're saving for a big purchase, an unexpected expense, or simply seeking to improve your money management, taking small, actionable steps can have a huge impact on your financial health.

Here are some easy and practical ways to enhance your financial planning:

1. Create a Budget

A budget is the foundation of any financial plan and is essential for your financial well-being. By tracking your income and expenses, you can identify areas to cut back and save more. Start by listing your monthly income and categorising expenses—from rent and groceries to entertainment. This clear picture of your finances not only helps you make informed decisions but also significantly reduces stress and anxiety, giving you a sense of control and confidence in managing your money.

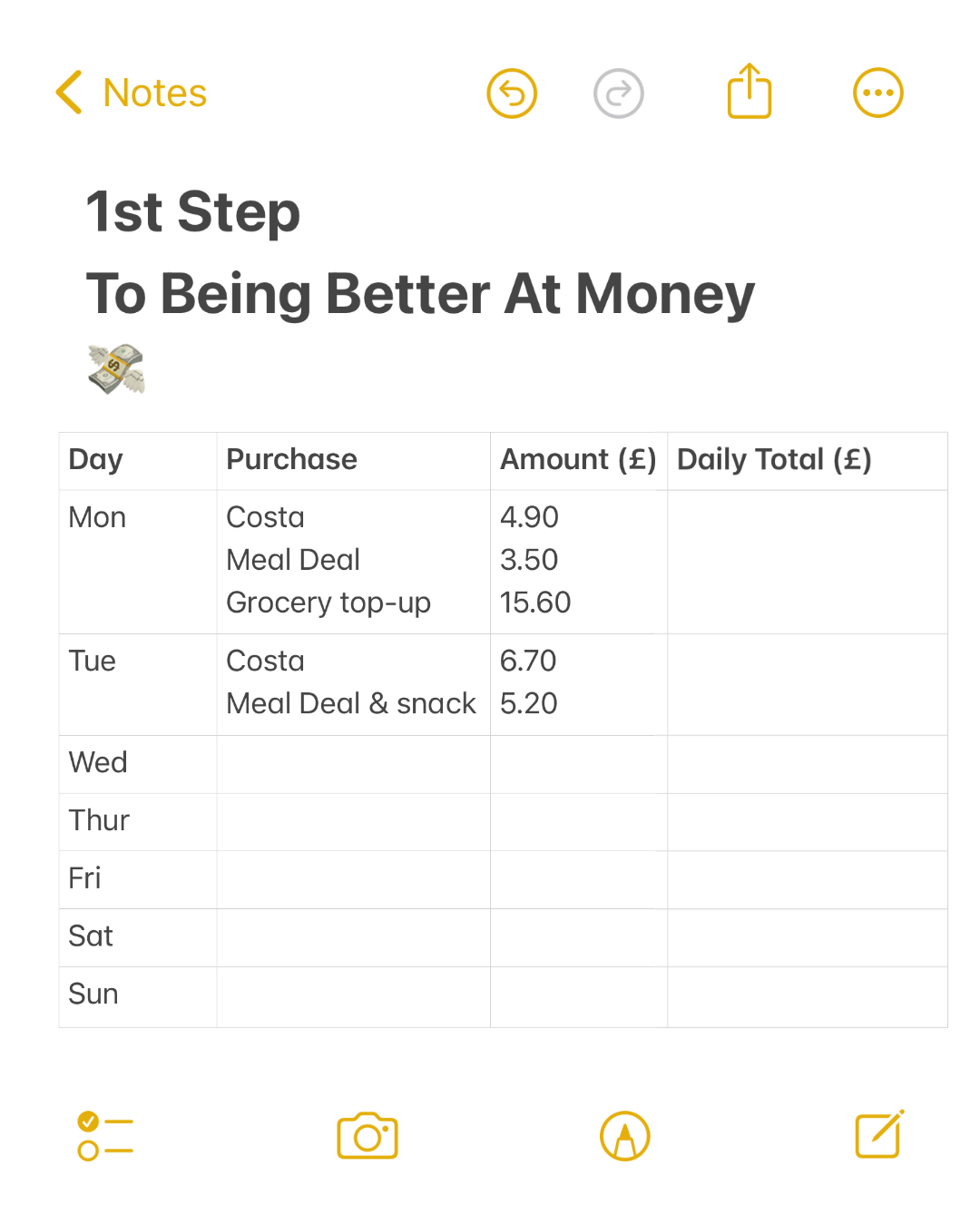

2. Track Your Expenses

Keeping track of where your money goes is crucial. Use apps or tools like Snoop Budget Planner to monitor your daily spending habits. This helps you stay accountable and reduces unnecessary expenditures. When you know exactly what you're spending on, it's easier to make informed adjustments and align your spending with your goals.

3. Set Clear Future Goals

Having a specific goal in mind motivates you to stick to your financial plan. Whether it's saving for a vacation, buying a house, or building a retirement fund, set SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) savings goals. Write them down and break them into manageable milestones to keep you on track.

Here’s an example:

- Specific: Save £2,000 for a summer family holiday

- Measurable: Save £167 per month for 12 months to meet the goal.

- Achievable: Set up a separate savings account for the trip and cut down on monthly subscriptions or other non-essential spending.

- Relevant: You want to go on a family holiday before your eldest goes to university

- Time-bound: Have the full £2,000 saved by June 1st, before the trip.

4. Automate Savings

Make saving a habit by automating the process. You can set up a direct debit that transfers a portion of your income into a savings account regularly. Automating savings ensures that you prioritise saving before spending, helping you to grow your wealth without even thinking about it.

Pro tip

If you work for the Military, MOD or are in receipt of a MOD pension, you can set up savings deposits directly from your salary. Deposits will go out before it hits your bank, ensuring your savings always tick in the background and making you less likely to dip into them.

5. Know Your Credit Score

Your credit score plays a critical role in financial opportunities like securing loans, renting properties, or even landing a job. Regularly check your credit score to ensure it remains healthy with sites like Experian or Clear Score, and take steps to improve it if needed. Paying off debts on time, reducing outstanding balances, and managing your credit responsibly can boost your score over time.

6. Build an Emergency Fund

Life is unpredictable, and unexpected expenses can arise at any time. Establishing an emergency fund can help protect you from financial setbacks, such as car repairs or job loss. Start by making small contributions that fit your budget; even a little can add up over time. While many suggest saving three to six months' worth of living expenses, it's important to remember that every bit counts. If reaching that goal feels daunting, don't be discouraged. Focus on saving what you can and aim to have something set aside for a rainy day. This financial cushion provides peace of mind and stability during uncertain times.

Financial planning doesn't have to be overwhelming. By following these simple tips—creating a budget, tracking expenses, setting goals, automating savings, monitoring your credit score, and building an emergency fund—you can take control of your financial future. The key is consistency and making small, manageable changes that lead to long-term success.

Make a budget to take the first step today and set yourself up for a financially secure future!